Tech companies slowly begin to deal with user finance transactions. We know there are already available payment networks like Google Pay and Samsung Pay are available. But they act like a third-party where your payments will happen in your band, and the transactions handled by them. You may receive rewards based on your payments. But, Now tech companies slowly introducing bank type transactions. It means you can use their service as a bank. They can work standalone. You don’t need to link your Credit card/Debit card to Pay services. You can use their card to make transactions, and you will receive exclusive offers on their platform. We know Samsung introduced a separate money service. Now Samsung Money SoFi Debit card Available in the US region. When you are in this area, you can sign up for your new Debit card from Samsung.

Why Samsung needs a separate SoFi Physical Debit card?

For a lot of reasons, Payment companies are tired of dealing with the banks. They can’t give customers what they want. When the transaction is a failure, they have to contact the Bank regarding this and come back to customers, which takes a long time. It is reasonable because they don’t know what happened in the Bank end. When they have data on the transaction and payment details, they can assist you quickly. It makes sense with digital payments. When you can pay instantly, you should get better support and control over your cash. That’s why Google is also working on its physical Debit card. You will receive better offers when you use these cards on their platform. Samsung is planning to give better discounts when you use the SoFi card in samsung.com for purchase.

Samsung Money by SoFi Features

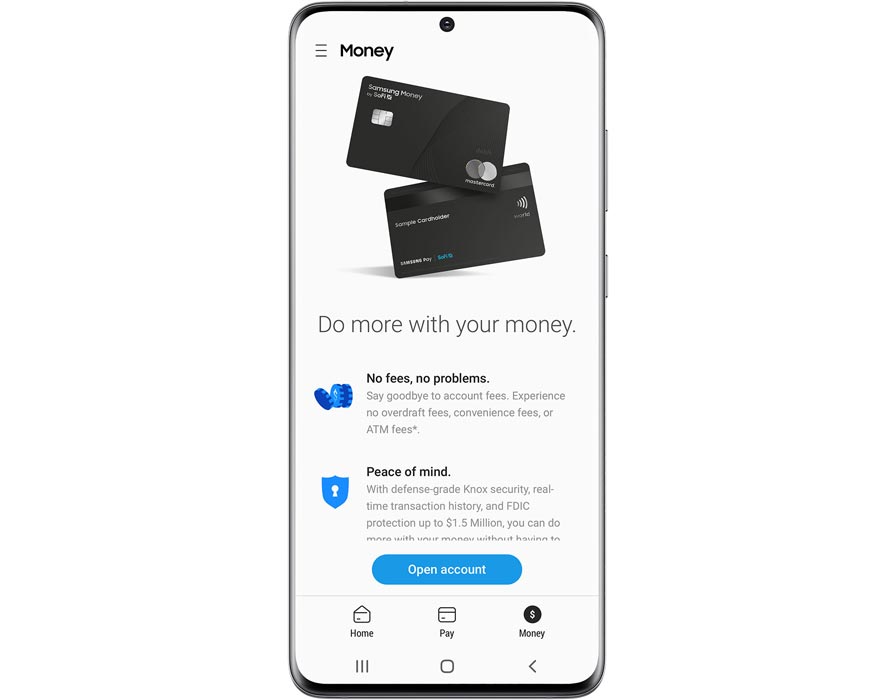

- No account fees to start and use the account. No ATM fees.

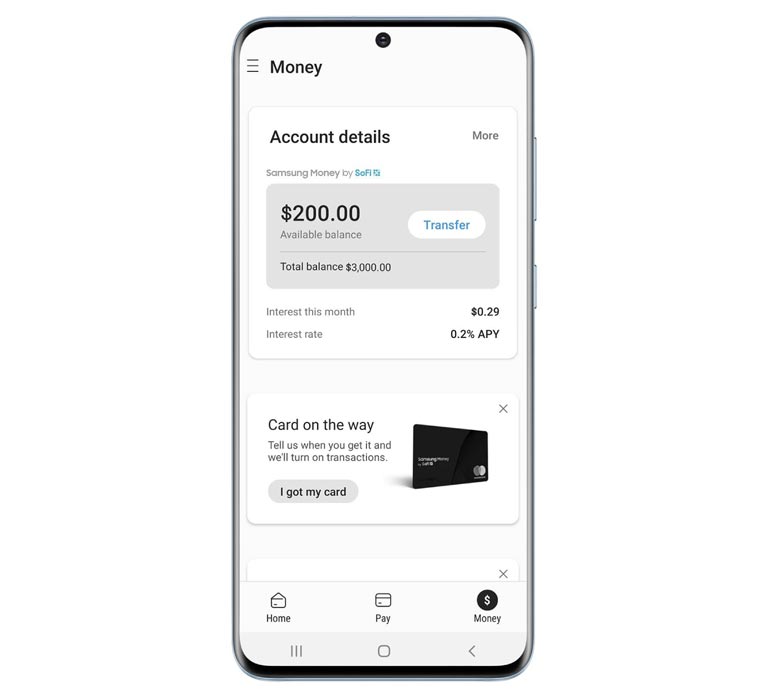

- Samsung Money will work like a Real bank account where you will receive interest for your money in the Samsung account.

- You will get Reward points for purchases. You can directly convert the points to money and add them to your account.

- Samsung will provide you a physical Debit card so that you can use the money available in your account where you can’t make digital transactions.

- You can make individual accounts or joint accounts. When you open a joint Account, users who are in the Samsung Money account can access the money with the same privilege as you. It is like sharing a family subscription.

- Your Account is FDIC insured for up to $1.5 million. It is vast compare with regular bank account insurance.

Physical Debit card Features

When you open an account in Samsung Money, You will get the Virtual and Physical Debit Card. It has some unique features that may not be available in your bank cards.

- Your card has only your name. There will be no Card number, Expiry date, and other details present in your Master card. When you want the card details, you can get the information in your mobile app, which is protected by Biometric or PIN authentication. This feature is similar to Google Debit card, Where you can generate a new card number if you want your card is lost.

- You have the full ability to freeze and unfreeze, Change PIN, and Allow trusted contacts to use the card from the app. Additionally, you can use two-factor authentication apps to tighten security.

- You can access the card in more than 55,000 locations with ATM fee reimbursement. If your card gets charged for the usage, Samsung will cover the fee cost.

How to fund your Samsung Money Account?

Like a regular Bank Accounts, You will get Account number. You can transact the money from your already existing accounts to Samsung Money. After the funding, you can use the funds from your Samsung Account. Since there is a low chance for physical offices, you have to do everything digitally.

How to Join in Samsung Money and get your SoFi Debit card?

Currently, the Sofi Debit card available only in the US region. When you are in the area, follow the below steps to activate your Samsung Money.

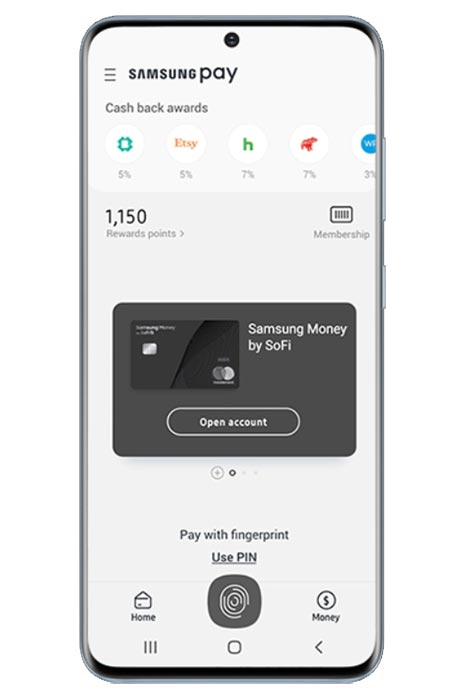

- Download Samsung Pay from Play Store.

- Open app and tab Money option. You will get the Samsung Money account.

- Initially, you need to enter your necessary details.

- Load some amount to your Samsung Money account. Now you have an official Account. The new account will be opened to you instantly when you first load the amount. When you deposit more than $1, You are eligible for your Physical Debit card.

- You will receive the Debit card within five business days in your mailing address.

How to Activate Samsung Money SoFi Debit card?

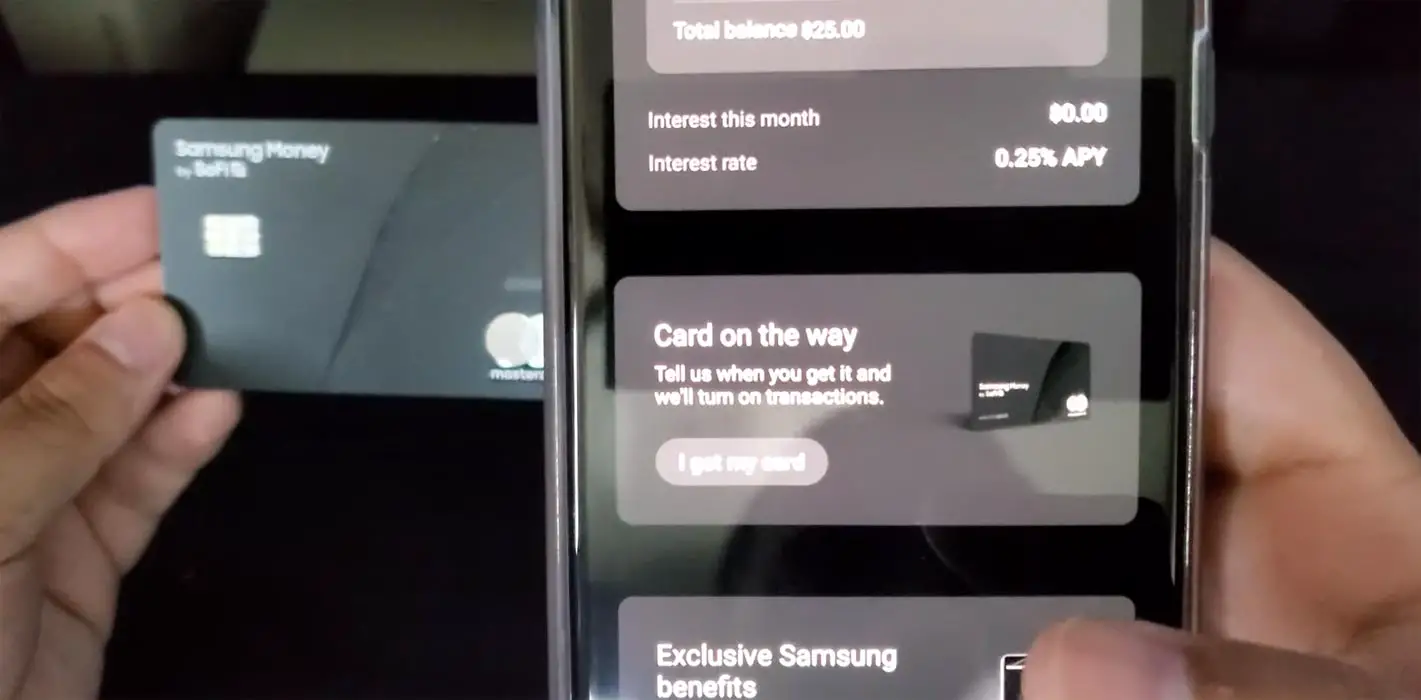

After getting a physical Debit card in the mail, you have to activate the card using Samsung Pay.

- Open the Samsung Pay app and tab Money.

- Select, “I got my card.”

- Turn on your mobile NFC. You have to tab the card in the back of your mobile or where your mobile NFC is working better.

- Samsung Pay app will detect the card and activate it for you. After the activation, you can control your Debit card from the app. You can change the PIN, get the card info like that. For further FAQ, you can refer to the official Samsung Page.

Wrap Up

Samsung is always fast in manufacturing. When they announce products, Most of the time, they already manufactured the product, or they are in the end-stage because Samsung announced the SoFi Debit card in May 2020. within a few months, it comes to people’s usage. Also, to attract users, they are offering the best discounts in their Samsung Online Store. It is common among the companies to promote the product with already existing solutions. Verizon also released their Credit card and announced offers if you use the card for bill payments. Compare with other debit cards; the Google Pay Debit card has better features. But As you know, when it comes to physical products, Google may take some time to reach its customers. What are your thoughts about the Samsung Money SoFi Debit card? Did you plan to use one? Comment below.

Selva Ganesh is the Chief Editor of this Blog. He is a Computer Science Engineer, An experienced Android Developer, Professional Blogger with 8+ years in the field. He completed courses about Google News Initiative. He runs Android Infotech which offers Problem Solving Articles around the globe.

Leave a Reply