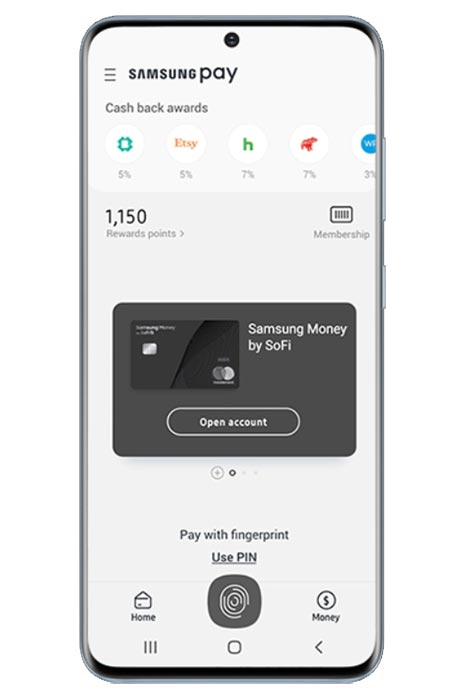

After we know Google is working on Google Pay physical debit card, Now Samsung announces the Samsung Money with Physical Debit card by SoFi. Samsung planned to move the Samsung Pay to Bank like account. Instead of treating as a wallet, Samsung Money will work as an individual or joint bank account. You will get rewards and interests like a regular Bank account. You may think, The main motto of the digital payments like Samsung Pay and Google Pay is to avoid using the Physical cards. Now they are working on the cards to return to the traditional way. But there are some details you should know why companies do this.

Why Samsung Money Cash Management Account by SoFi?

You may wonder Samsung already has Samsung Pay then why they need a separate Cash Management platform. When a company has a vast customer base and resource, They always want everything in-house. Samsung is a company that produces all parts of its products in-house. The finance sector is a sensitive area where people make transactions only when they trust. It means when they make transactions, they have massive trust in the companies.

Beyond just a product company, Samsung has people trust, and they want to go one step further. They already have good transactions on Samsung Pay, and they want to show to the world they also have the Customer based Finance banking. One hand, it can be useful to users. On the other hand, you should show to the world you also have a facility like Apple Pay, Google Pay. It is the reason why OnePlus is working on its payment platform OnePlus Pay. Samsung Pay is a wallet service, But Samsung Money is a real bank account.

Samsung Money by SoFi Features

- No account fees to start and use the account. No ATM fees.

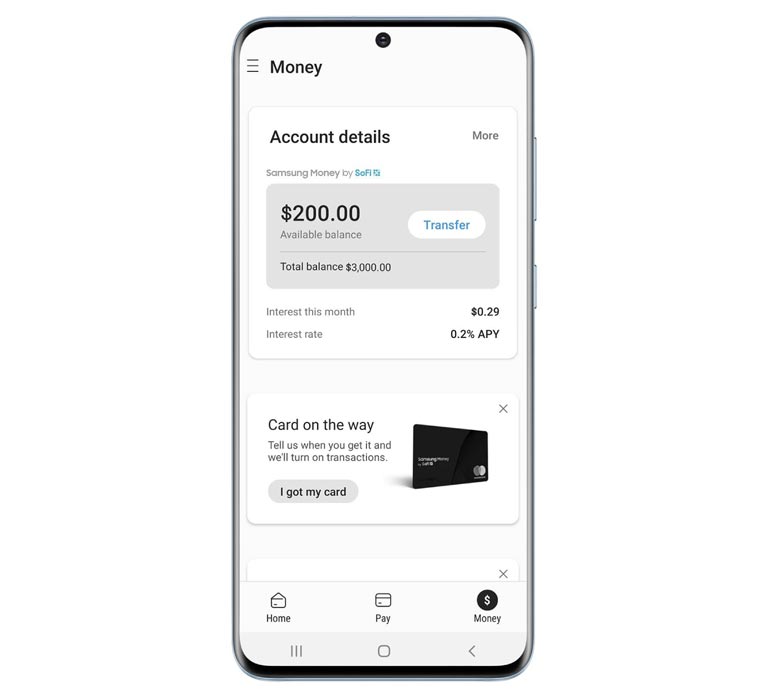

- Samsung Money will work like a Real bank account where you will receive Interest for your money in the account.

- You will get Reward points for purchases. You can directly convert the points to money and add them to your account.

- A physical Debit card will be provided so that you can use the money available in your account where you can’t make digital transactions.

- You can make individual accounts or joint accounts. When you open a joint Account, users who are in the Account can access the money with the same privilege as you. It is like sharing a family subscription.

- Your account is FDIC insured for up to $1.5 million. It is vast compare with regular bank account insurance.

Physical Debit card Features

When you open an account in Samsung Money, You will get the Virtual and Physical Debit Card. It has some unique features that may not be available in your bank cards.

- Your card has only your name. There will be no Card number, Expiry date, and other details present in your Master card. When you want the card details, you can get the information in your mobile app, which is protected by Biometric or PIN authentication. This feature is similar to Google Debit card, Where you can generate a new card number if you want your card is lost.

- You have the full ability to freeze and unfreeze, Change PIN, and Allow trusted contacts to use the card from the app. Additionally, you can use two-factor authentication apps to tighten security.

- The card can be accessed in more than 55,000 locations with ATM fee reimbursement. If your card gets charged for the usage, Samsung will cover the fee cost.

How to fund your Samsung Money Account?

Like a regular Bank Accounts, You will get Account number. You can transact the money from your already existing accounts to Samsung Money. After the funding, you can use the funds from your Samsung Account. Since there is a low chance for physical offices, you have to do everything digitally.

How to Join in Samsung Money?

The feature will be available for most of the Samsung users in late summer. But you can join the waitlist to get preference. Samsung already has a Samsung Pay app widely used by most of Samsung customers. So, An update can do a lot of things quickly.

Wrap Up

Samsung Money concept is similar to the Google Pay Debit card. But you will get high rewards; Offers compare with Google. Because Samsung pay have wide variety of tie-up with companies where you always get some offers for everything you purchase. Also, The card concept looks secure. But As I mentioned earlier, the finance sector should be careful. Customers quickly lose trust when they can’t get the failed transaction money, or the payment doesn’t work. That’s why Samsung Money is manged by fintech company SoFi. They can deal with this kind of financial works where Samsung will not involve directly. It is always a wise idea to place the expert in the places.

Paper features and Real-time usage are always different. We can see how Samsung Money can be a success once they rolled out the feature to users. Do you feel Samsung Money is Good? Or It may become another substitute payment platform when the primary doesn’t work? Comment below.

Selva Ganesh is a Computer Science Engineer, Android Developer, and Tech Enthusiast. As the Chief Editor of this blog, he brings over 10 years of experience in Android development and professional blogging. He has completed multiple courses under the Google News Initiative, enhancing his expertise in digital journalism and content accuracy. Selva also manages Android Infotech, a globally recognized platform known for its practical, solution-focused articles that help users resolve Android-related issues.

Leave a Reply