Tesla, a leading electric vehicle manufacturer, has brought good news for potential buyers of its popular Model 3. After factoring in federal tax credits, the initial cost of a Tesla Model 3 has the potential to drop back below the highly desired $35,000 threshold. This article explores the recent changes in federal tax credits and their impact on the price of a Tesla Model 3. Moreover, it sheds light on the requirements for eligibility, state incentives, and the affordability of owning a Model 3. Tesla 3 is still eligible for a $7500 Federal Tax Credit. Based on the State you are living in, You can get additional discounts too.

The Price of a Tesla Model 3

Tesla has built a reputation for its dedication to making electric vehicles more affordable for a wider audience. The launch of the Model 3 was Tesla’s initiative to create an electric car that starts at a price point of $35,000. However, due to various factors, the price of the Model 3 exceeded this threshold. Fortunately, federal tax credits came to the rescue.

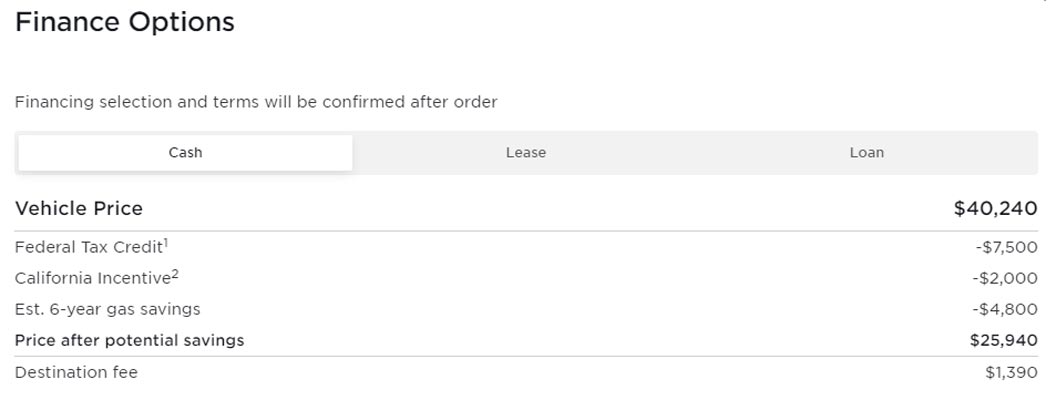

Federal tax credits significantly reduced the price of a Tesla Model 3. In April 2023, the tax credits for the entry-level Standard Range and Long Range RWD models were reduced by 50%. This reduction led to a higher starting price for these models, disappointing some potential buyers. Nevertheless, Tesla’s website has recently been updated to State that every new Model 3 is eligible for the full $7,500 federal tax credit in the United States. As a result, buyers can once again enjoy the initial aim of a $35,000 price tag.

State Incentives and Discounts

Deal of the Day

Anker 737 Power Bank Now Available for $74: Cyber Monday Deal

Moreover, when purchasing a Tesla Model 3, buyers can capitalize on a range of state incentives and discounts in addition to the federal tax credit. California, located near Tesla’s Fremont factory, offers substantial incentives for electric vehicle purchases. Taking California as an example, the price of a Tesla Model 3 can be significantly reduced. While the pre-tax price might be $41,630, the price could go down to $32,130 after factoring in federal and State incentives. In certain States and Regions, buyers can leverage additional incentives to potentially lower the price of a Tesla Model 3 below $30,000.

Requirements for Tax Credit Eligibility

To fully understand the benefits of purchasing a Tesla Model 3, it is essential to have a comprehensive understanding of the eligibility criteria for tax credits. Some cars stopped qualifying for the tax credit due to sourcing requirements for batteries and components. These requirements specify that 40% of the minerals used in the batteries must be “extracted or processed in the United States or a U.S. free-trade agreement partner,” and 50% of the components must be “manufactured or assembled in North America.”

These sourcing requirements are implemented to promote domestic production and ensure that the tax credits support local industries. However, it’s worth noting that these percentages increase over time. By 2027, 80% of battery minerals and components must meet the sourcing requirements for vehicles to be eligible for the tax credit. Therefore, it is crucial for manufacturers to continuously improve their sourcing strategies to maintain eligibility for the tax credit.

FAQs

Can I still claim the $7,500 federal tax credit if I buy a used Tesla Model 3?

No, the $7,500 federal tax credit is only available for new electric vehicles and does not apply to used Tesla Model 3 cars.

How do I determine the incentives and discounts available in my State?

You can visit your State’s official website. You can also check the Department of Energy’s website to learn about incentives and discounts available in your State. They provide information on specific incentives, tax credits, or rebates offered for electric vehicles.

Are there any other electric vehicle models eligible for the federal tax credit?

Other electric vehicle models from manufacturers such as Nissan, Chevrolet, and Ford are eligible for the federal tax credit. You can check with the manufacturer or refer to the Internal Revenue Service (IRS) website. You can get a list of suitable electric vehicle models.

What happens if a Tesla Model 3 does not meet the sourcing requirements for tax credit eligibility?

Your Tesla Model 3 or other electric vehicle does not meet the sourcing requirements. The requirements state that some battery minerals and components must be sourced from the United States or a U.S. free-trade agreement partner and manufactured or assembled in North America. It will not qualify for the federal tax credit.

Will the federal tax credit be phased out entirely in the future?

Yes, the federal tax credit for electric vehicles is subject to phase-out. Once a manufacturer sells a certain number of electric cars, the tax credit starts reducing and eventually phases out completely. However, it’s essential to stay updated on legislative decisions. Because the availability and future of the federal tax credit can change often, consulting with tax professionals or electric vehicle experts can provide the most accurate information.

Wrap Up

Owning a Tesla Model 3 has become even more enticing with the restoration of the $7,500 federal tax credit. Tesla’s recent announcement states that every new Model 3 is eligible for the entire tax credit. It brings the price closer to the original target of $35,000. With the additional benefits of state incentives and discounts, the affordability of a Tesla Model 3 becomes even more apparent. It is an excellent opportunity for environmentally conscious individuals to transition to electric vehicles and experience their numerous advantages.

Selva Ganesh is the Chief Editor of this Blog. He is a Computer Science Engineer, An experienced Android Developer, Professional Blogger with 8+ years in the field. He completed courses about Google News Initiative. He runs Android Infotech which offers Problem Solving Articles around the globe.

Leave a Reply