Google Wallet and Google Pay have long been prominent in the tech sphere. The unveiling of Google Wallet for Android at the I/O 2022 conference marks a significant step forward, offering Android users a multifaceted online wallet tailored to diverse requirements. This announcement solidifies Google’s dedication to advancing the digital payment domain, offering users accessible, secure options for financial management. Integrating Google Wallet into the Android ecosystem underscores the company’s strategy to streamline transactions and enhance user experience. With features designed to meet modern payment demands, Google aims to simplify transactions and foster trust among its user base. The move reflects Google’s ongoing commitment to innovation and reinforces its position as a leader in digital finance solutions.

History of Google Wallet

Google Wallet made its debut in 2011, aiming to revolutionize mobile payments. However, its initial version faced challenges, limiting its usage to Nexus phones and specific card types. Over time, it transformed, paving the way for a more accessible payment ecosystem. Despite the hurdles, Google remained steadfast in its pursuit of a seamless payment experience, leading to the evolution of Google Wallet into a multifaceted platform.

Android Pay: The Replacement

In 2015, Google unveiled Android Pay, marking the transition from Google Wallet to contactless payments. This shift was primarily driven by the need for a more user-friendly experience, eliminating the hassle of separate app downloads. Android Pay’s integration into the Android operating system further streamlined the payment process, making it effortlessly accessible to millions of users worldwide. With features like tokenization and fingerprint authentication, Android Pay set new standards for security and convenience in mobile payments.

Coexistence of Google Wallet and Android Pay

Despite the emergence of Android Pay, Google Wallet persisted as a peer-to-peer payment platform. Users could effortlessly transfer funds and withdraw money, maintaining its relevance alongside its successor. This coexistence allowed Google to cater to a broader range of user preferences, ensuring that individuals could choose the platform that best suited their needs. Moreover, it demonstrated Google’s commitment to innovation and adaptability in the ever-evolving digital landscape.

Integration of Google Wallet with Google Pay

Deal of the Day

Anker 737 Power Bank Now Available for $74: Cyber Monday Deal

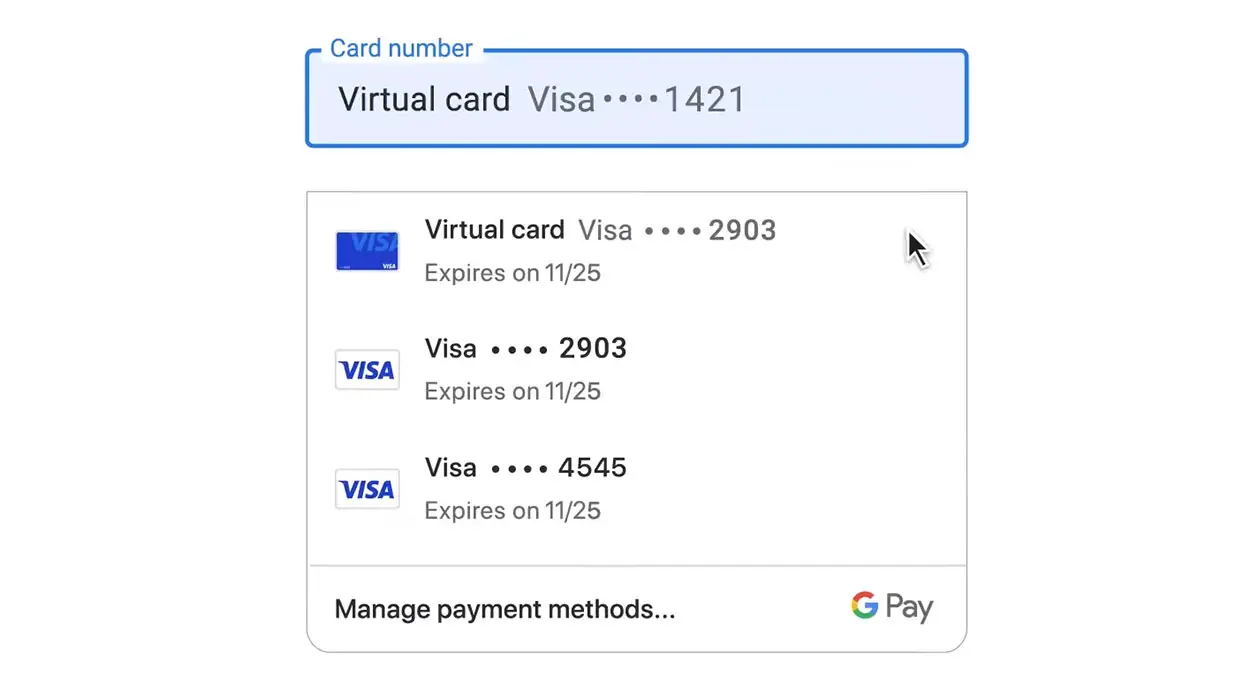

The integration of Google Wallet with Google Pay consolidated the functionalities of both platforms. Users now enjoy a unified experience, combining the security of Google Wallet with the financial management tools of Google Pay. This integration simplified the user experience and facilitated seamless transitions between payment methods and services. Whether purchasing online or sending money to a friend, Google Pay offers a comprehensive solution for all your payment needs.

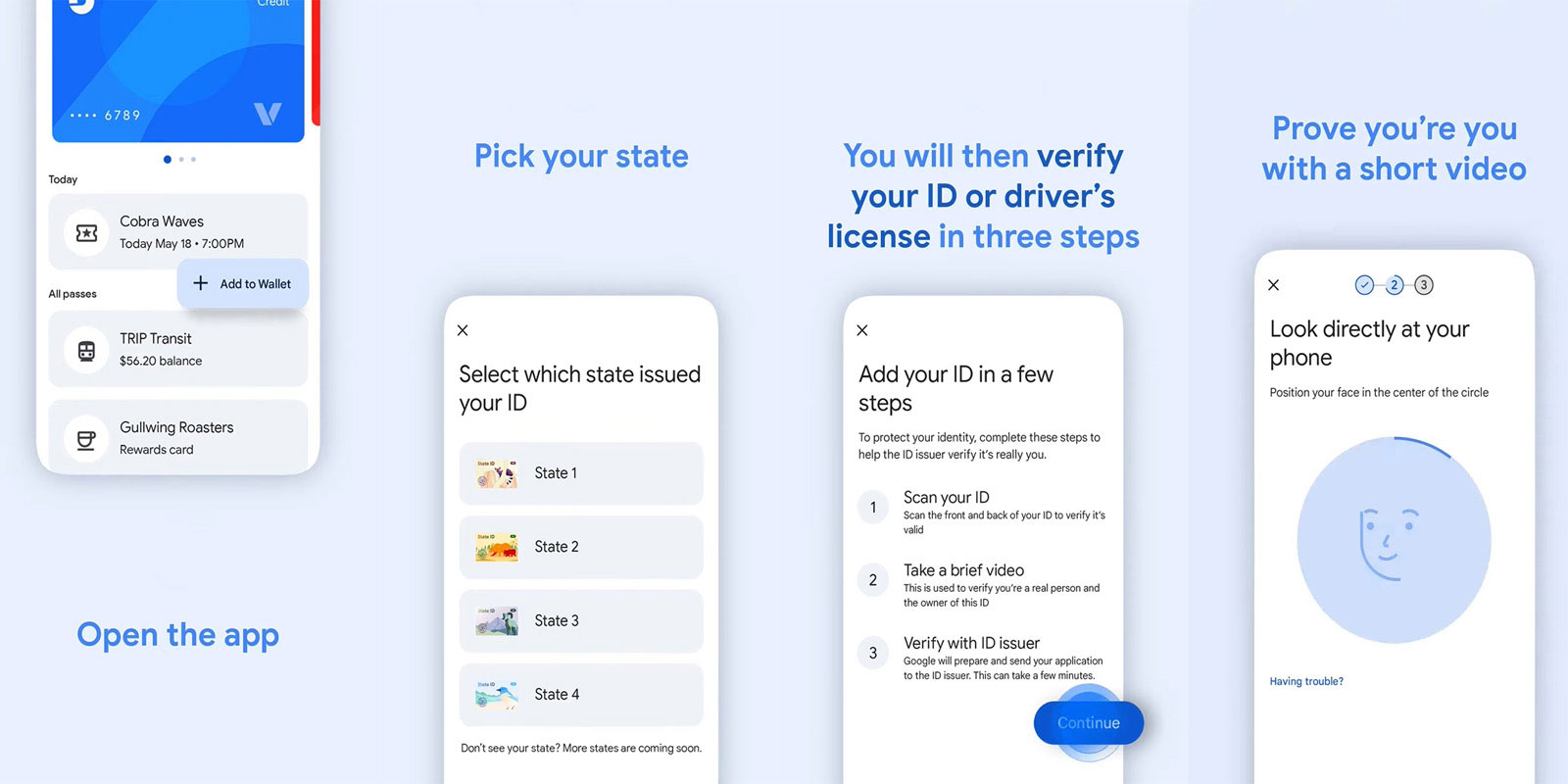

Understanding Google Wallet

Google Wallet is a digital repository for essential cards, tickets, and keys. Its robust security measures ensure the safe storage of sensitive information, providing users with peace of mind. With multi-layer encryption and biometric authentication, Google Wallet prioritizes user security without compromising convenience. Moreover, its intuitive interface makes adding, removing, or managing payment methods easy, ensuring a seamless user experience across devices.

Features of Google Pay

Google Pay goes beyond mere transactions, offering insights into spending habits, rewarding users for eligible transactions, and providing access to exclusive merchant offers. Its intuitive interface and personalized recommendations make managing finances a breeze, empowering users to make informed decisions about their money. Whether it’s tracking expenses, earning cashback, or discovering deals from favourite retailers, Google Pay puts the power of financial management in the palm of your hand.

Key Differences between Google Wallet and Google Pay

While both platforms cater to digital payment needs, their usage scenarios and target audience distinctions are noteworthy. Google Wallet focuses on secure storage, whereas Google Pay emphasizes financial management and rewards. This difference in focus reflects Google’s commitment to providing users with tailored solutions for their diverse needs. Whether you’re looking to secure your payment information or maximize your savings, Google has you covered with its payment and finance management tools suite.

FAQs

Is Google Wallet still available?

Yes, Google Wallet has been integrated into Google Pay, offering enhanced functionalities and a unified user experience.

Can I transfer money using Google Wallet?

Google Wallet’s peer-to-peer payments feature allows you to transfer money to friends and family effortlessly, making it convenient to split bills or send funds securely.

What are the benefits of using Google Pay?

Google Pay provides insights into your spending habits, rewards for eligible transactions, and access to exclusive merchant offers, helping you make the most of your money.

How secure is Google Wallet?

Google Wallet employs robust security measures, including multi-layer encryption and biometric authentication, to safeguard your payment information and ensure a secure digital wallet experience.

Can I use Google Pay to make contactless payments?

Yes, Google Pay facilitates contactless payments, allowing you to make transactions seamlessly with your Android device, in-store, online, or through supported apps and services.

Wrap Up

Google Wallet and Google Pay stand as complementary pillars within Google’s ecosystem, accommodating many user preferences and needs. From providing secure storage for payment credentials to offering insightful financial analytics, Google’s suite of digital finance solutions ensures a cohesive and intuitive payment experience. Through relentless innovation and seamless integration across platforms, Google maintains its position as a trailblazer in digital payments, driving the evolution of financial transactions.

By prioritizing user convenience, security, and accessibility, Google empowers individuals and businesses to navigate the digital economy confidently and easily. As the finance landscape continues to evolve, Google remains steadfast in its commitment to shaping the future of payments, revolutionizing how individuals and organizations engage with money in an increasingly interconnected world.

Selva Ganesh is the Chief Editor of this Blog. He is a Computer Science Engineer, An experienced Android Developer, Professional Blogger with 8+ years in the field. He completed courses about Google News Initiative. He runs Android Infotech which offers Problem Solving Articles around the globe.

Leave a Reply