Intuit’s recent announcement disclosed plans to integrate the widely used budgeting app Mint into its existing service, Credit Karma, starting from January 1st, 2024. This strategic move has ignited curiosity regarding whether Credit Karma will seamlessly adopt the unique budget-tracking functionalities that Mint users have grown accustomed to. The merger of these two financial platforms holds the potential to offer users a comprehensive and streamlined experience for managing their finances, encompassing both credit monitoring and budgeting tools. However, concerns linger about potential changes to Mint’s interface and functionality post-integration. Users are eager to see if the transition will enhance or alter their budgeting experience. As the integration date approaches, the financial community anticipates further details on harmonizing these services and the benefits they may bring to users’ economic well-being.

The Evolution of Mint and Credit Karma

Mint’s Genesis (2009)

Intuit’s acquisition of Mint in 2009 revolutionized budget management for users worldwide.

Mint provided a free platform for users to monitor budgets, manage expenses, negotiate bills, and oversee subscriptions.

Intuit’s Venture into Credit Karma (2020)

In 2020, Intuit acquired Credit Karma, a service offering similar features like credit score checks, credit-building guidance, and credit monitoring.

However, Credit Karma did not initially incorporate Mint’s budget tracking tool.

The Transition: What to Expect

Missing Features on Credit Karma

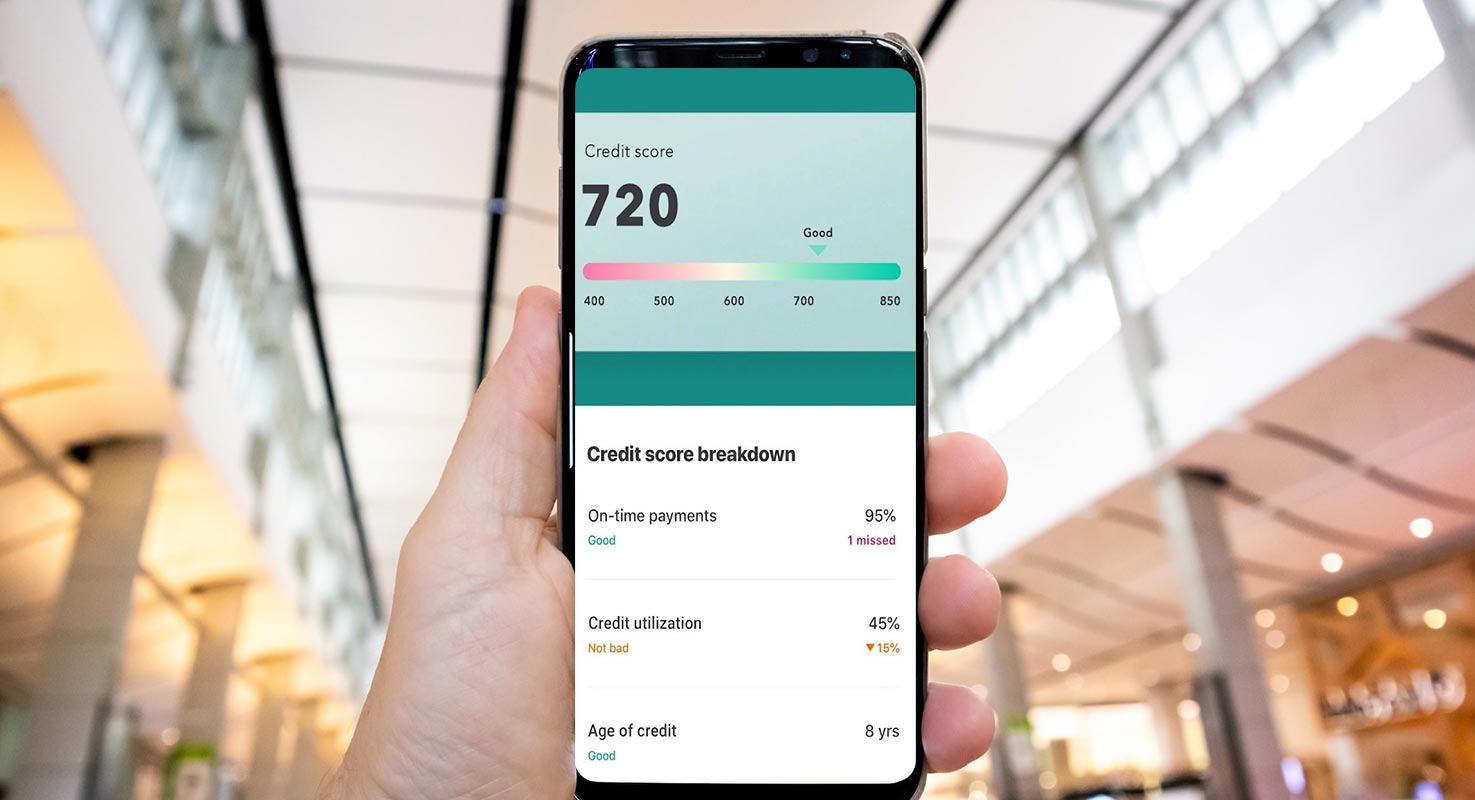

Credit Karma’s current experience cannot set monthly and category budgets, as highlighted in a support page statement by Intuit.

Instead, the app emphasizes building awareness of spending habits and tracking savings.

Future Developments on Credit Karma

Intuit assures users of forthcoming features, including enhanced transaction viewing, expenditure tracking, and comprehensive financial account aggregation.

Seamless Transition Process

Mint users can smoothly transition to Credit Karma by logging into the Credit Karma app from their Mint accounts.

Afterward, accessing Mint profiles will no longer be possible, but users can choose to download and delete their Mint data if they prefer not to migrate.

User Benefits of Migrating to Credit Karma

Enhanced Features on Credit Karma

Users can expect to maintain a unified view of their financial accounts, transactions, spending patterns, cash flow, and net worth trends.

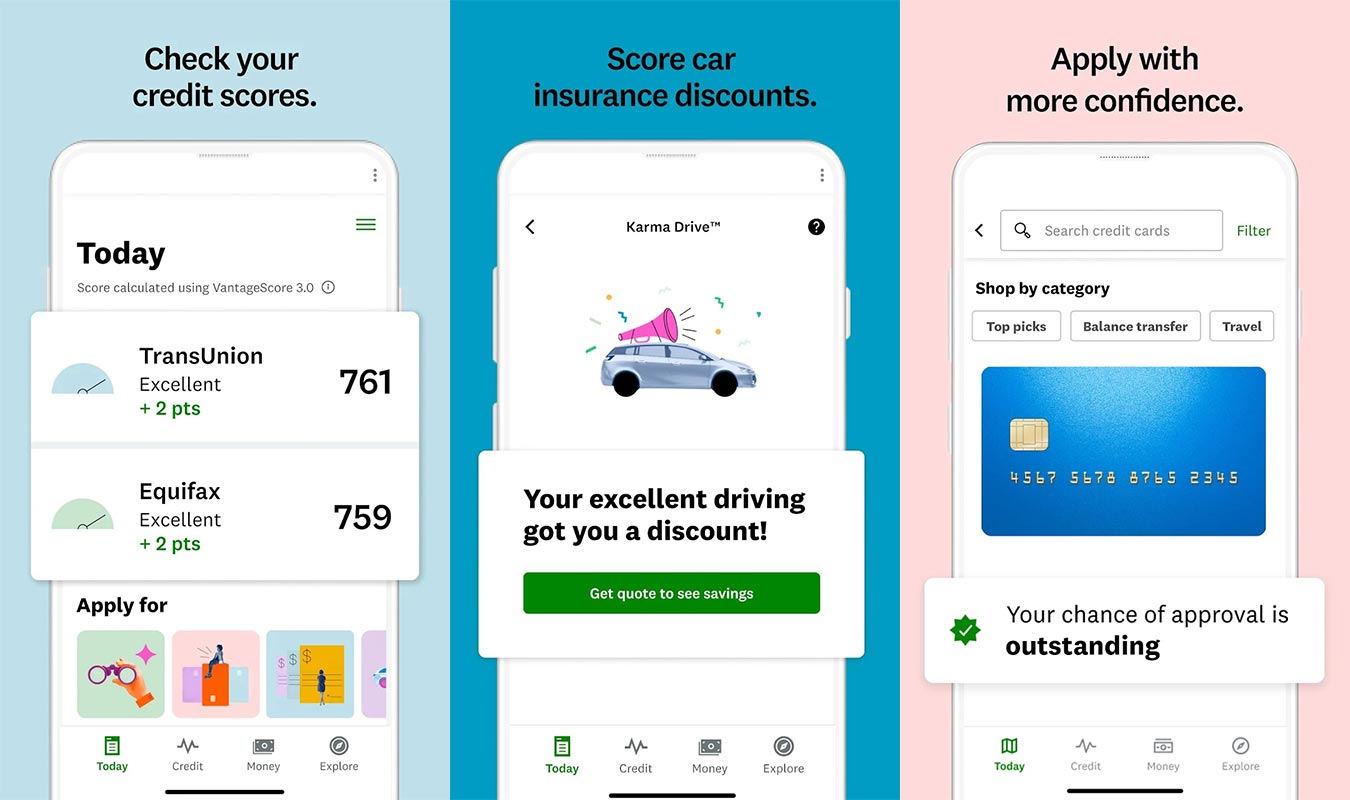

Additionally, Credit Karma offers new features like dual credit bureau score monitoring and personalized credit recommendations.

Monitoring Drive Scores

Credit Karma’s drive score monitoring could lead to potential savings on car insurance, providing users with an added financial advantage.

Addressing User Concerns

Transition Duration

Users who have been with Mint for an extended period should anticipate some time for their data to be seamlessly set up in Credit Karma. Notifications will be sent once the process is complete.

Farewell to Mint

Upon transitioning to Credit Karma, users will no longer have access to their Mint profiles. However, all historical financial account data will be retained.

Discrepancies in Credit Scores

It’s important to note that Mint retrieves credit scores from TransUnion, while Credit Karma utilizes both TransUnion and Equifax. Consequently, some variations in scores may occur.

Understanding Net Worth Differences

Net worth figures may appear different in Credit Karma compared to Mint. The article explains why and offers guidance on updating the data.

Handling Credit Card, Loan, and Asset Information

The article provides insights into how Credit Karma handles credit card, loan, home, and car equity information, outlining any necessary actions for users.

Navigating Mint Data

Downloading Mint Data

Users seeking to download their Mint data will find step-by-step instructions within the article, ensuring a seamless process for preserving their financial records.

Deleting Mint Data

For those who choose not to integrate Mint data with Credit Karma, the article guides users through safely deleting their Mint data while highlighting potential impacts on the Net Worth experience.

FAQs

Why should I connect my Mint account to Credit Karma?

By connecting your Mint account to Credit Karma, you can securely transfer your financial accounts, historical balances, and net worth graph to enjoy a unified financial overview.

How do I connect my Mint account to Credit Karma?

The article provides clear instructions for both existing Credit Karma users and those new to the platform, ensuring a hassle-free transition of financial data.

Can I continue using Mint after migrating to Credit Karma?

Unfortunately, once you’ve moved to Credit Karma, access to your Mint profile will no longer be available. However, your historical financial data will accompany you.

Why might my credit scores appear different on Mint and Credit Karma?

The article explains the distinction in credit score retrieval methods between Mint (TransUnion) and Credit Karma (TransUnion and Equifax), shedding light on potential score variations.

How can I download my Mint data?

Clear instructions are provided for users wishing to download their Mint data, ensuring the preservation of their financial records for future reference.

Wrap Up

Intuit’s recent announcement disclosed plans to integrate the widely used budgeting app Mint into its existing service, Credit Karma, starting from January 1st, 2024. This strategic move has ignited curiosity regarding whether Credit Karma will seamlessly adopt the unique budget-tracking functionalities that Mint users have grown accustomed to. The merger of these two financial platforms holds the potential to offer users a comprehensive and streamlined experience for managing their finances, encompassing both credit monitoring and budgeting tools. However, concerns linger about potential changes to Mint’s interface and functionality post-integration. Users are eager to see if the transition will enhance or alter their budgeting experience. As the integration date approaches, the financial community anticipates further details on harmonizing these services and the benefits they may bring to users’ economic well-being.

Selva Ganesh is a Computer Science Engineer, Android Developer, and Tech Enthusiast. As the Chief Editor of this blog, he brings over 10 years of experience in Android development and professional blogging. He has completed multiple courses under the Google News Initiative, enhancing his expertise in digital journalism and content accuracy. Selva also manages Android Infotech, a globally recognized platform known for its practical, solution-focused articles that help users resolve Android-related issues.

Leave a Reply