Worldwide all countries promote Electric based Vehicles. We still get electricity based on some pollution production. We are slowly moving towards Gree ENergy, and The Electric based vesicles are related to one another. So, The changes have to happen from the user side, Or Else it will affect the people directly. To Promote Electric Vehicles, Come to Governments give incentives, Tax Credits, and other offers. But as per the recent Notice, USA EV Tax Credit Rules have been Delayed by the Treasury Department until March 2023. The reason is based on many things like understanding the Vehicle Price structures and other in-field studies.

USA EV Tax Credit Rules

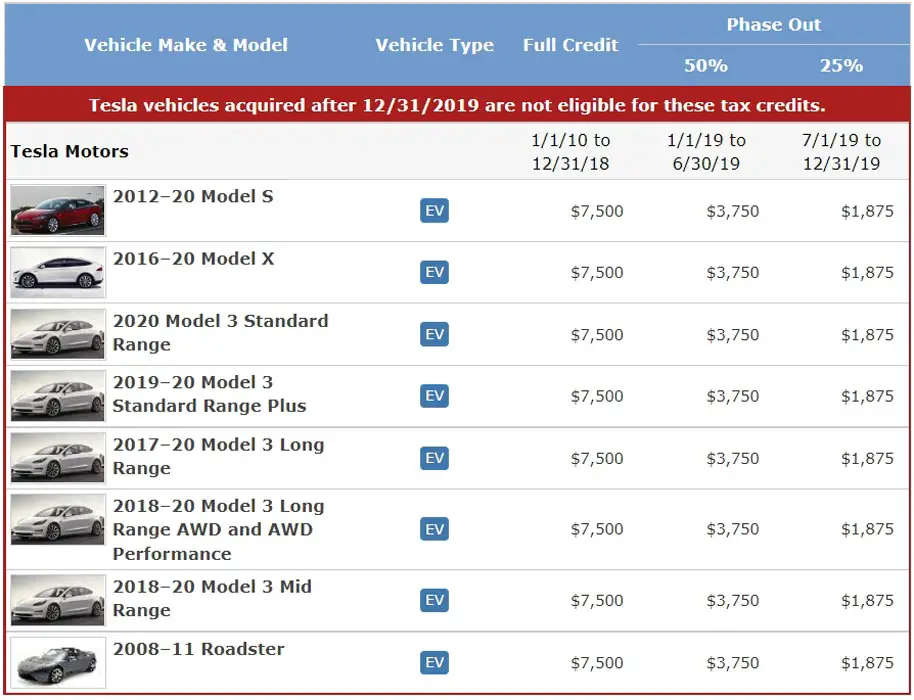

The EV tax credit is a federal income tax credit available to individuals and businesses that purchase qualifying EVs. The credit is worth up to $7,500 and is applied to the purchaser’s federal income tax return for the year the EV was purchased.

EV Tax Credit Rules Delayed until March 2023

Electric vehicle (EV) tax credits have been a popular incentive for consumers looking to switch to a more environmentally-friendly mode of transportation. However, recent news has indicated that these tax credits may be delayed until March 2023.

One of the main reasons for the delay of the EV tax credit is the high demand for EVs. In recent years, the popularity of EVs has skyrocketed, leading to a significant increase in the number of credits claimed. As a result, the budget allocated for the recognition has been exhausted, causing the delay.

Another reason for the delay is the need to review and update the list of qualifying EVs. The Environmental Protection Agency (EPA) determines the list of qualifying EVs based on the vehicle’s fuel efficiency and emission levels. The EPA is currently reviewing and updating the list to ensure that it reflects the latest advancements in EV technology. You can refer to the complete list of supporting EVs- Electric Vehicles with Final Assembly in North America.

Delays will Affect the EV sales

The delay of the EV tax credit has raised concerns among consumers and the EV industry. Many consumers were counting on the tax credit to help offset the high upfront cost of an EV. The delay could lead to a slowdown in sales for the EV industry, as consumers may be less inclined to purchase an EV without the tax credit.

There are also concerns that the delay could disproportionately impact low-income and minority communities, which may rely more on the tax credit to afford an EV.

Despite these concerns, it is essential to note that the EV tax credit is not being eliminated and will still be available to consumers. In the meantime, other incentives are available to help offset the EV cost. For example, some states offer their EV tax credits or rebates and tax credits for installing EV charging infrastructure at home or work.

Additionally, many automakers offer incentives and financing options for purchasing an EV. It is worth considering these options when shopping for an EV.

Wrap Up

In conclusion, the delay of the EV tax credit until March 2023 is due to a combination of high demand and the need to update the list of qualifying EVs. While the delay may be inconvenient for some consumers and the EV industry, it is essential to remember that the credit is not being eliminated, and other incentives are still available to help offset the cost of purchasing an EV. What are your thoughts about the EV Tax Credit Delay? Share it below.

Selva Ganesh is the Chief Editor of this Blog. He is a Computer Science Engineer, An experienced Android Developer, Professional Blogger with 8+ years in the field. He completed courses about Google News Initiative. He runs Android Infotech which offers Problem Solving Articles around the globe.

Leave a Reply