You may wonder why successful transactions happen in a few seconds to minutes. But Failed Bank Transaction settlement takes 3-5 days in the bank. Even though it is a bit off-topic, since most users begin to use Mobile apps to make transactions, It will be helpful. Have you ever wondered why it takes so long for your bank transactions to settle? It can be frustrating when you transfer money from one account to another, and the funds are not immediately available. This delay in transaction settlement can be attributed to several factors, including bank procedures, security protocols, and technology limitations. This article will discuss why transaction failure settlement takes 3-5 business days in a bank. We will also explain the various steps involved in transferring money between accounts and explore the measures banks take to ensure the safety of their customers’ funds.

Why does it take so long to settle a Failed Bank Transaction?

The simple answer is that banks need time to verify the funds and ensure the transaction is legitimate. Here are some of the reasons why transactions take 3-5 business days to settle:

Bank procedures

When you initiate a transaction, the bank must process it, which involves several steps. The bank must verify the transaction details, including the account numbers and the transferred amount. This process can take time, especially if the transaction details have discrepancies or errors.

Security Protocols

Banks have strict security protocols to prevent fraud and protect their customers’ funds. Before a transaction can be settled, the bank must verify that the funds are available and the transaction is legitimate. This involves checking the account balances, verifying the owner’s identity, and reviewing the transaction history.

Technology limitations

Despite the advancements in technology, there are still limitations that can slow down the transaction settlement process. For example, different banks use different technology systems, which can cause delays in transferring funds between institutions. Additionally, technology glitches can occur, which can cause further delays.

Steps involved in transferring money between accounts

To understand why transaction settlement takes 3-5 business days, it’s essential to understand the various steps involved in transferring money between accounts. Here is a breakdown of the typical process:

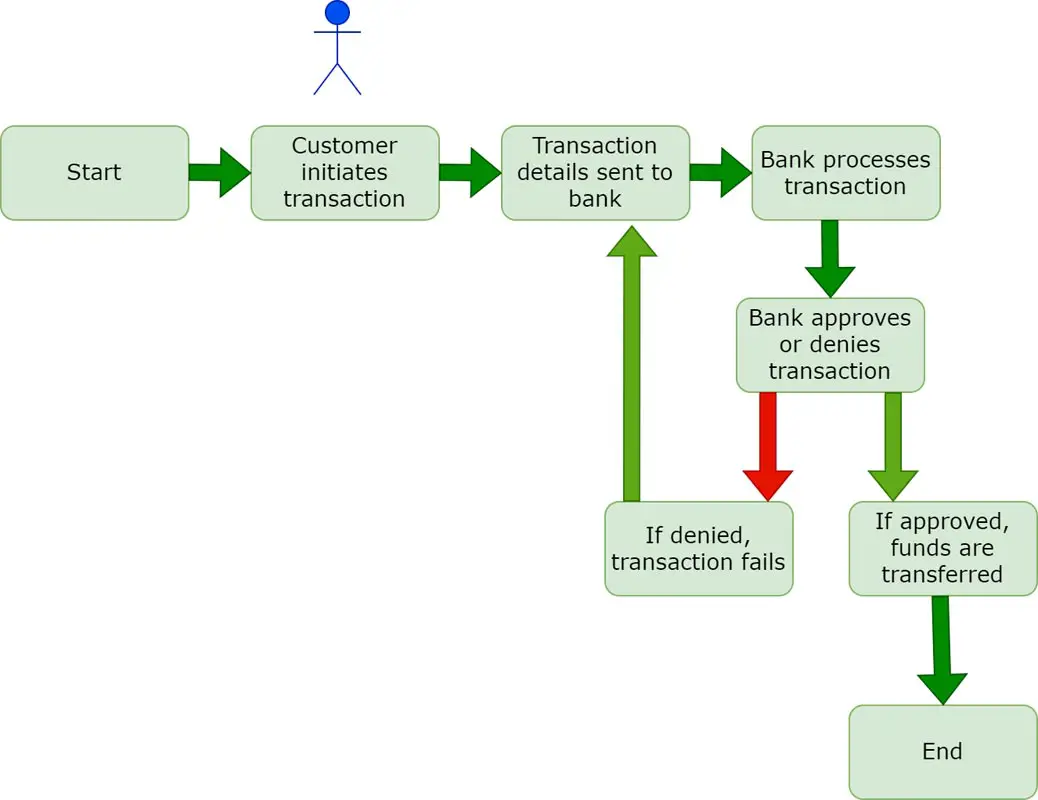

- Start -> Customer initiates transaction -> Transaction details sent to bank -> Bank processes transaction -> Bank approves or denies transaction -> If consented, funds are transferred -> If denied, the transaction fails -> End.

Initiation

The first step in transferring money is to initiate the transaction. This can be done online, over the phone, or in person at the bank. The person creating the transfer must provide the account numbers, the amount to be transferred, and other relevant details.

Processing

Once the transaction is initiated, the bank needs to process it. This involves verifying the transaction details and ensuring that the funds are available.

Sending the funds

Once the transaction is processed, the funds are sent to an automated clearinghouse (ACH). The ACH is responsible for sorting and moving the funds to the receiving bank.

Receiving the funds

The receiving bank then receives the funds and credits them to the account of the person receiving the transfer.

Measures banks take to ensure the safety of their customers’ funds

Banks have strict security measures in place to ensure the safety of their customers’ funds. Here are some of the actions banks take:

Two-factor authentication

Many banks use two-factor authentication to verify their customers’ identities. This involves providing a password and a security code sent to the customer’s phone or email.

Fraud detection

Banks use fraud detection systems to monitor transactions and detect any suspicious activity. If a transaction is flagged as potentially fraudulent, the bank will investigate further before settling the transaction.

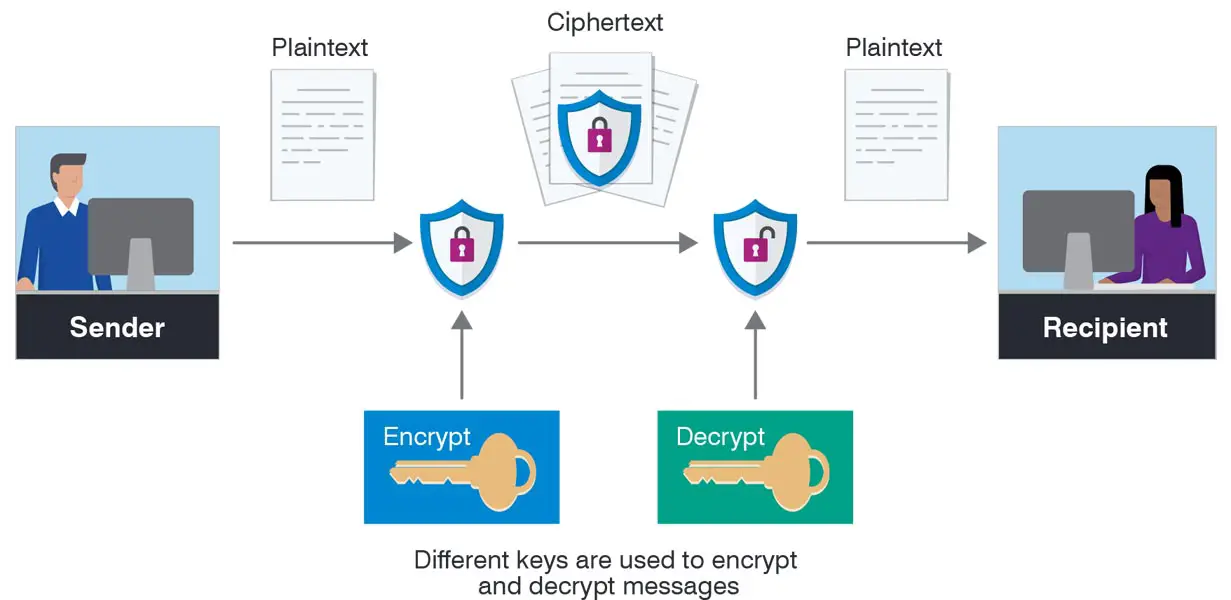

Encryption

Banks use encryption to protect their customers’ personal and financial information. Encryption ensures that any information transmitted between the customer and the bank is secure and cannot be intercepted by third parties.

Factors that Affect Failed Bank Transaction Settlement Time

The Settlement time may vary based on the banks and countries.

| Transaction Issue | Resolution Timeframe |

|---|---|

| Customer account debit-But cash not came from the ATM | Reversal of failed transaction within T+5 days |

| The card account was debited- but the beneficiary didn’t get it. | Transaction to be reversed within T+1 day |

| Account debited, but confirmation not received at merchant loc. | Auto-reversal within T+5 days |

| Transaction on e-commerce websites with no confirmation record | Auto-reversal within T+5 days |

| Payments made via card/mobile wallet but beneficiary not credited | They will reverse the transaction in the Remitter’s account within one day (T+1). |

| You made the payment via card/mobile wallet, but the merchant location did not provide any confirmation. | They will reverse the transaction in the Remitter’s account within one day (T+1). |

The transaction amount

The more significant the amount, the longer it takes for the money to settle in the receiver’s account. This is because more significant transactions are subject to scrutiny to ensure the transaction is legitimate and the money is available.

The type of account

The type of account you’re transferring money to can also affect the settlement time. For example, if you’re transferring money to a checking account, it may settle faster than if you’re transferring money to a savings account.

The time of day

The time of day when you initiate the transaction can also affect the settlement time. Transactions undertaken during business hours tend to settle faster than those created after or on weekends.

The type of bank

Different banks have different settlement policies and procedures. Some banks may settle transactions faster than others.

FAQs

Why does it take so long for my Failed Bank Transaction to settle?

Banks take time to settle transactions to prevent fraud and ensure the transaction is legitimate.

Can I speed up the settlement process?

Unfortunately, there’s no way to speed up the settlement process. Banks have policies and procedures; they need time to ensure the transaction is legitimate and the money is available.

Can I check the status of my transaction?

Yes, most banks have online banking services that allow you to check the status of your transaction. You can also contact your bank’s customer service with any concerns.

Wrap Up

In conclusion, transaction failure in banking can be a frustrating experience for customers. The customer and the bank often have no control over various factors that cause it. These factors may include technical glitches, network failures, or issues with the customer’s account or payment method.

However, banks can take steps to minimize the occurrence of transaction failures by investing in robust and reliable systems, providing clear and transparent communication to customers, and offering prompt and efficient customer service to resolve any issues that may arise. As customers, we can also take proactive steps, such as ensuring our accounts are up to date and using secure payment methods to minimize the risk of transaction failures.

Banks and customers are responsible for ensuring successful transactions and a positive banking experience. By working together and taking proactive steps, we can reduce the frequency of transaction failures and create a more seamless and reliable banking system.

Source, (2), (3), (4), (5), (6), (7- Downloadable PDF)

Selva Ganesh is the Chief Editor of this Blog. He is a Computer Science Engineer, An experienced Android Developer, Professional Blogger with 8+ years in the field. He completed courses about Google News Initiative. He runs Android Infotech which offers Problem Solving Articles around the globe.

Leave a Reply